kentucky sales tax on vehicles

Average Local State Sales Tax. Arizona California Florida Indiana Massachusetts.

Tax Alert Sales Tax In Kentucky Blue Co Llc

Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

. Amount of taxable receipts included on line 22 of the sales tax returns from sales to customers that are residents of the following states. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Include these receipts on the sales tax return and.

Andy Beshear announced today that he is. Be subject to the sales or use tax. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

Motor Vehicle Usage Tax Sales Tax Use Tax May 1 2014. The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of. KRS139470 is amended to read as follows.

How to Calculate Kentucky Sales Tax on a Car. This page describes the taxability of. House Bill 380 Part 36-Sales of Motor Vehicles to Non-ResidentsSection 1.

Is the usage tax refundable if an individual titles a salvage vehicle and pays Motor Vehicle Usage. The vehicle sales tax in Kentucky is 6 on all car sales and there are no additional sales taxes by city or county. Yes the 6 percent Kentucky sales tax will apply to sales of motorcycles if sold to a resident of one of the eight states involved.

Municipal governments in Kentucky are also allowed to collect a local-option sales tax that ranges from. 16 2022 To help Kentuckians combat rising prices due to inflation brought on by the global pandemic Gov. Instead of implementing a rental tax on motor vehicles Kentucky charges a motor vehicle.

Interactive Tax Map Unlimited Use. Maximum Local Sales Tax. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky.

You can find these fees further down on the page. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title. Kentucky does not charge any additional local or use tax.

Kentucky has a statewide sales tax rate of 6 which has been in place since 1960. Vehicle rental excise tax. Maximum Possible Sales Tax.

The state of Kentucky has a flat sales tax of 6 on car sales. Ad Lookup Sales Tax Rates For Free. Relative Content The Kentucky Transportation Cabinet is responsible for all title and watercraft related.

Are services subject to sales tax in Kentucky. Sellers use our guide to keep current on all nexus laws and the collection of sales tax. While Kentuckys sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. Kentucky has a 6 statewide sales tax rate but also has 209 local tax jurisdictions including cities towns counties and special districts that. Ad There are currently more than 12000 state local tax jurisdictions across the 50 states.

The retailer must collect Kentuckys 6-percent sales tax on the fee. The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered. 2 Motor vehicles which are not subject to the motor vehicle usage tax established in KRS 138460 or the U-Drive-It tax established in KRS 138463 shall be.

A Sold to a Kentucky resident registered for use.

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

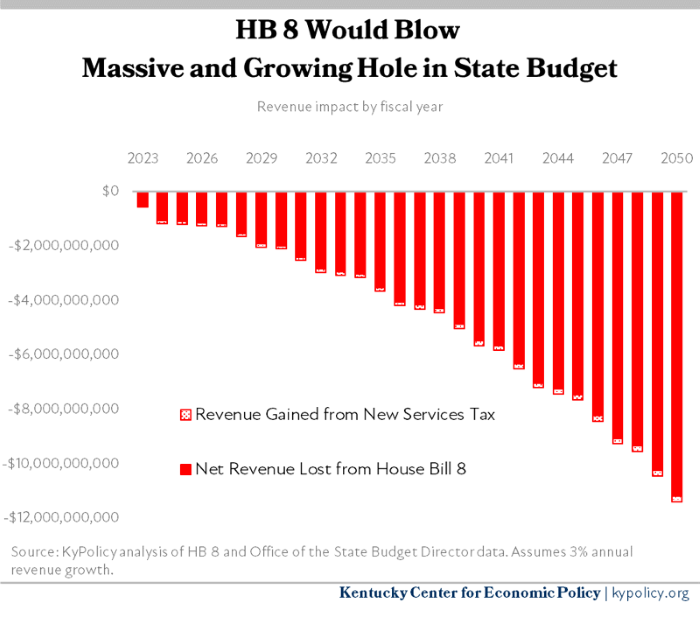

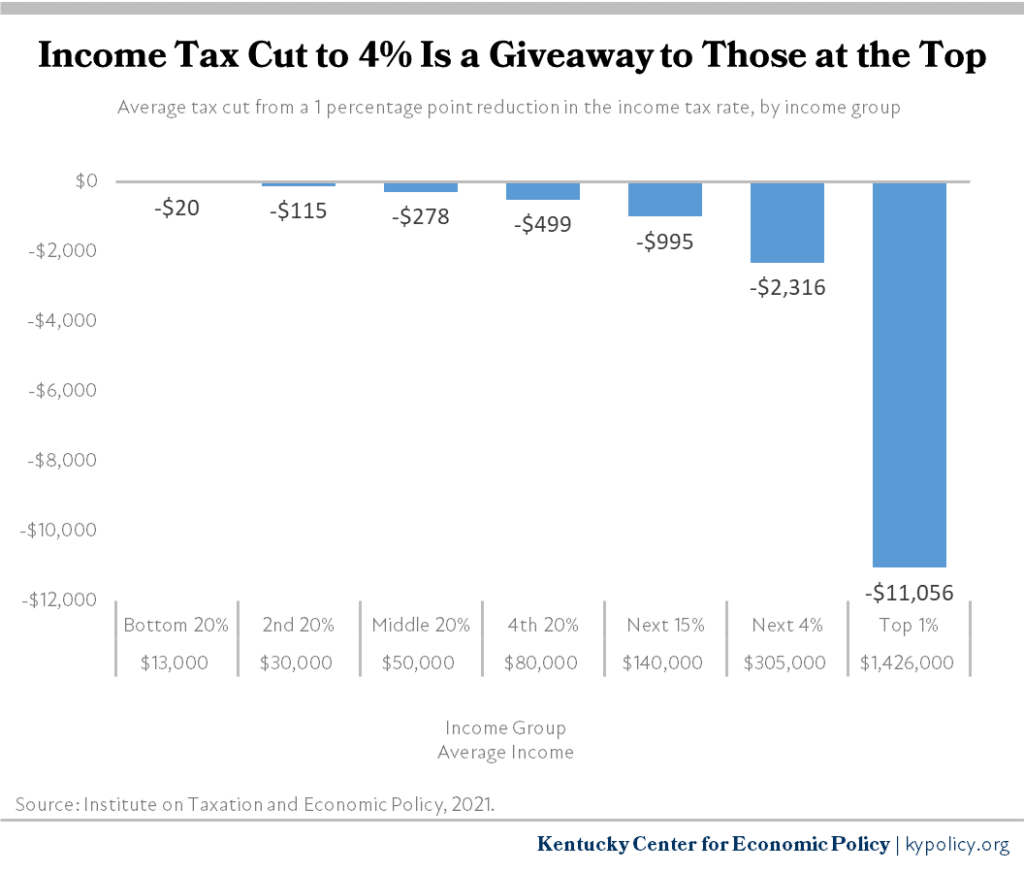

House Tax Bill Would Devastate Kentucky S Budget For A Giveaway To The Wealthy Kentucky Center For Economic Policy

Car Tax Refund Process Begins In Ky

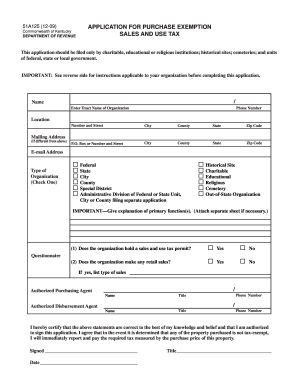

Kentucky Exemption Tax Form Fill Out And Sign Printable Pdf Template Signnow

Do You Qualify For A Vehicle Sales Tax Deduction

House Tax Bill Would Devastate Kentucky S Budget For A Giveaway To The Wealthy Kentucky Center For Economic Policy

Beshear Proposes Sales Tax Decrease

How To File And Pay Sales Tax In Kentucky Taxvalet

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky S Car Tax How Fair Is It Whas11 Com

Lease To Ownership Madison County Clerk S Office

Form 51a270 Fillable Certificate Of Sales Tax Paid On The Purchase Of A Motor Vehicle

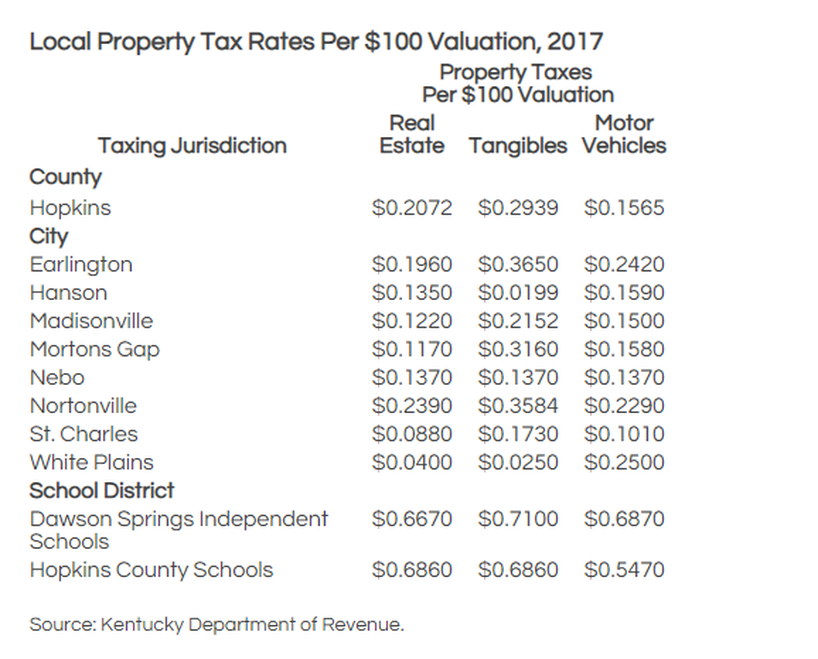

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

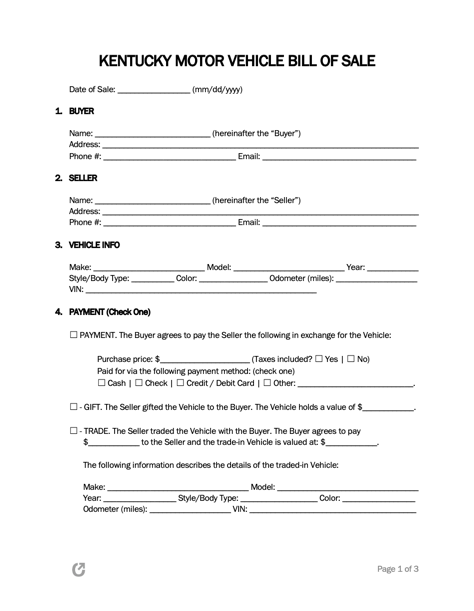

Free Kentucky Bill Of Sale Forms 5 Pdf Word Rtf

Gov Beshear Pitches Sales Tax Decrease To Fight Inflation In Kentucky

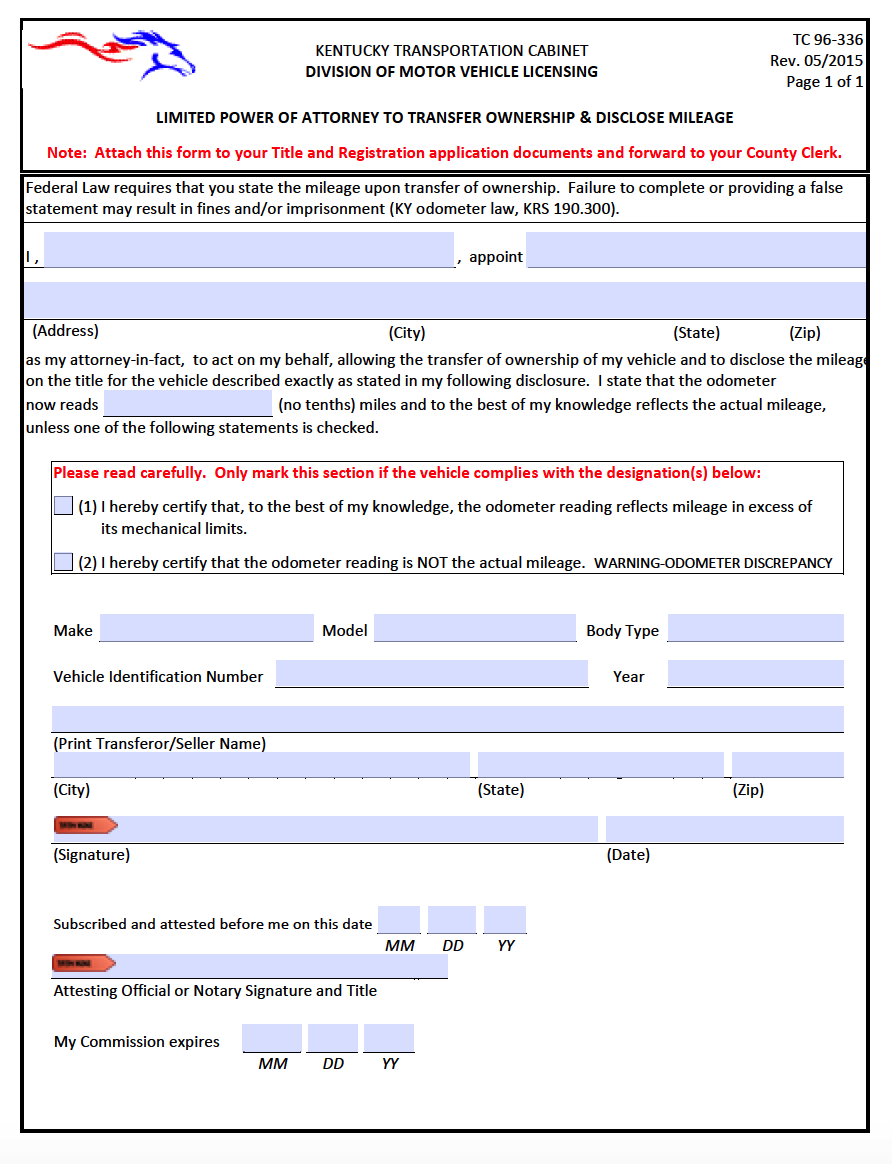

Free Motor Vehicle Power Of Attorney Kentucky Form Tc 96 336

Used Cars Trucks Suvs For Sale In Hazard Ky Tim Short Chrysler Llc

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price